Renters Insurance in and around Chicago

Renters of Chicago, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through deductibles and savings options on top of family events, your pickleball league and managing your side business, takes time. But your belongings in your rented apartment may need the incredible coverage that State Farm provides. So when the unexpected happens, your sports equipment, shoes and videogame systems have protection.

Renters of Chicago, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Chicago Choose State Farm

Renters insurance may seem like not a big deal, and you're wondering if it's really necessary. But pause for a minute to think about what would happen if you had to replace all the valuables in your rented home. State Farm's Renters insurance can help when fires or break-ins damage your possessions.

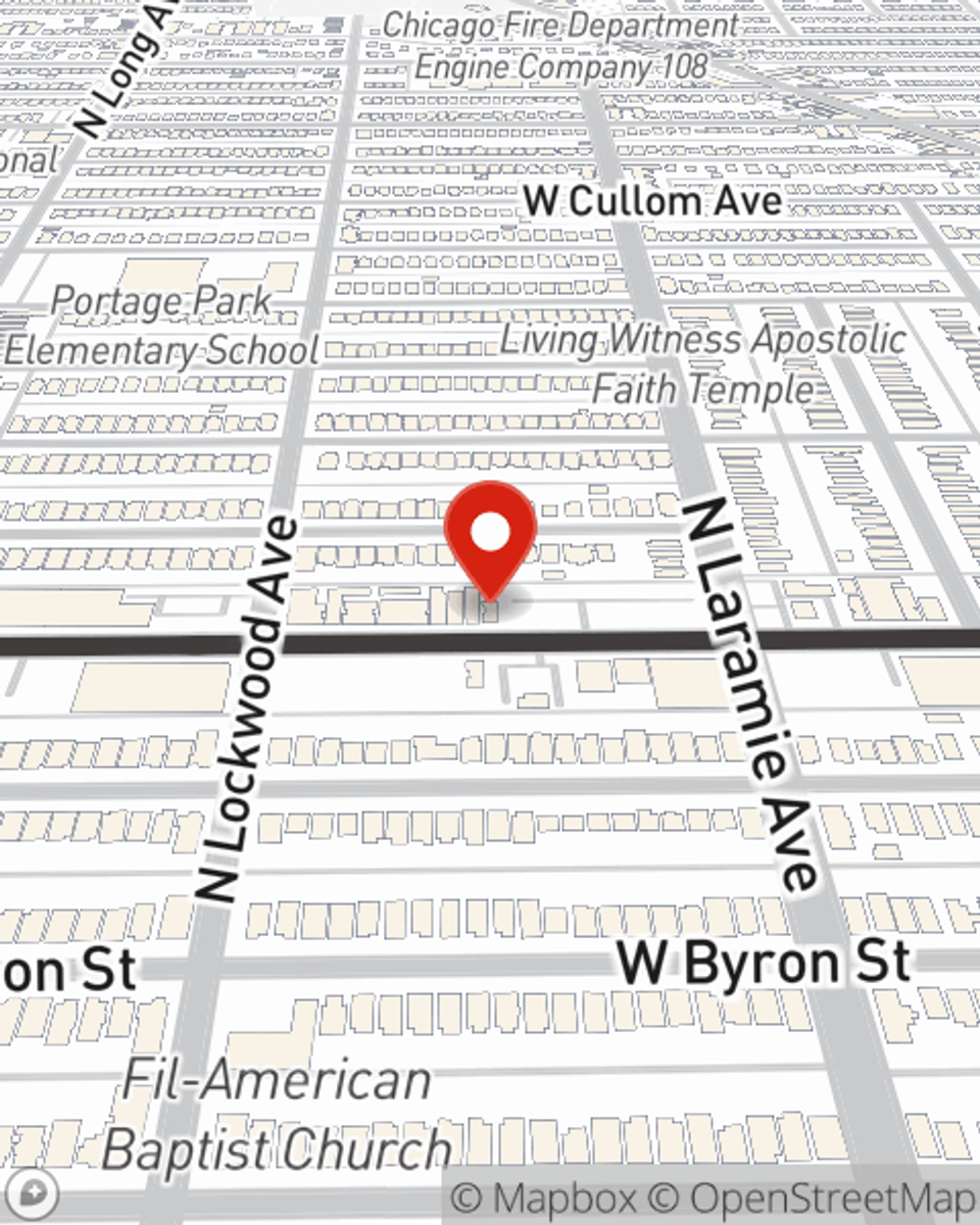

If you're looking for a reliable provider that offers a free quote on a renters policy, visit State Farm agent Dan Ray today.

Have More Questions About Renters Insurance?

Call Dan at (773) 777-8277 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.